2023 GLOBAL ORDER BOOK

Global Order Book data shows that the superyacht industry has been buoyed by burgeoning demand during the pandemic.

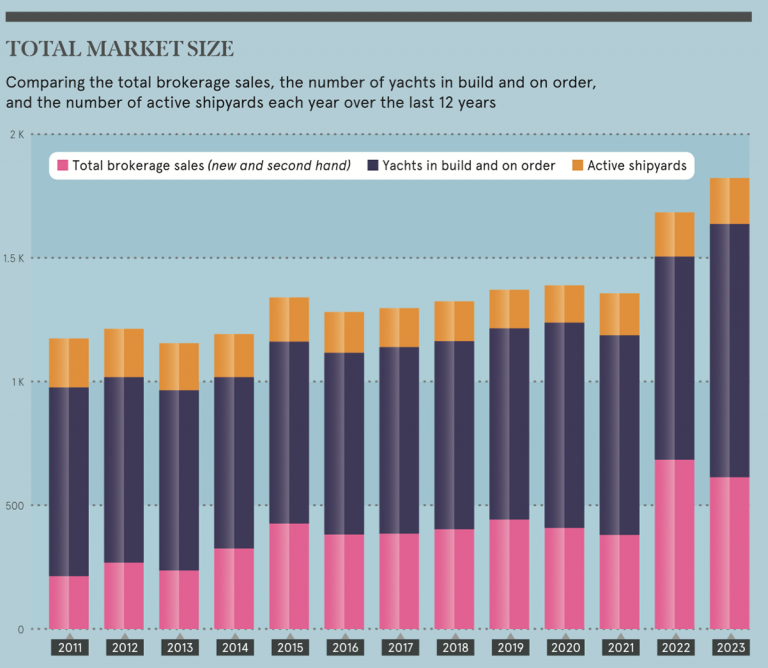

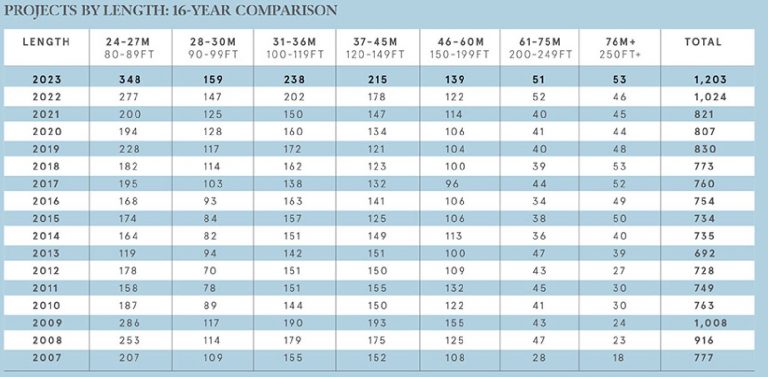

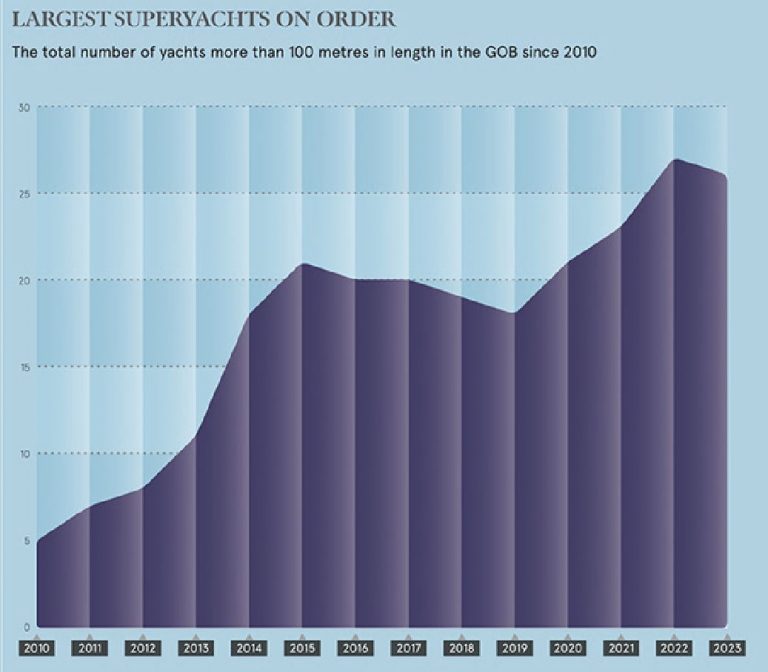

The number of superyachts on order or in build around the world has climbed to a new record. Our research reveals 1.203 projects al shipyards globally, slated for delivery between now and 2027, up from 1,024 last year. While the year-on- year growth looks impressive at 17.5 per cent, the results are announced by two disrupting factors: Covid -19-related supply chain delays: and sanctions that have kept some yachts from being delivered to Russian nationals. We have established that 95 superyachts slipped from their anticipated delivery year and remain in our count of yachts under construction as of 1 September 2022, including 18 whose owners are subject to international sanctions due to Russia’s invasion of Ukraine. Although yards are prohibited from taking money from sanctioned Russian sources or working on behalf of sanctioned individuals, these projects are still considered active. Without these factors, and had delivery schedules been maintained, the current order would likely stand at 1090 projects, a more modest 6.4 per cent increase from the previous year. This remains record-breaking order book but one that indicates that the industry’s steady growth since the global financial crisis may be about to plateau.

In a related finding, we recorded a sharp increase in the number of yachts, including small series yachts, being built to customer order rather than to a dealer’s order or on speculation by the builder. In previous years these “spec” boats or dealer slots could be flipped to a buyer and ‘modified to the new owner’s taste in the final few months of construction. In the 2018 Global Order Book, for example, 47.5 per cent of the 773 boats under construction were speculative projects looking for an owner. Following the buying frenzy that began in the summer of 2020, the 2022 Global Order Book showed 25.5 per cent of orders were speculative. The latest figure is just 19.5 per cent. With a more secure revenue stream, yards are retiring debt, making acquisitions and investing in infrastructure.

TOP CATEGORIES

Trends spotted last year are confirmed in this latest report, particularly the strength of the smaller superyacht market. The smallest category we track, from 24 to 27 metres, grew by 71 projects – from 277 to 348, representing an increase of 25.6 percent. The next category (28 to 30 metres) grew hy a more modest 8.2 per cent, from 147 to 159 units. Taken together, all projects below 30 metres total 507 units, and make up 42 per cent of the Global Order Book.

Every size category shows growth, except one – yachts between 61 and 75 metres, which declined by a single hull this year to 51.

When combined, the total gross tonnage of all yachts under construction equals 551,431, an increase of 6.3 per cent over last year. But interestingly, the average gross tonnage per project is falling, from 507 to 459GT, a decrease of 9.5 percent, which is explained by the success of semi-custom yachts below 30 metres and by the clever ways designers and builders are meeting client demands to stay below 500GT.

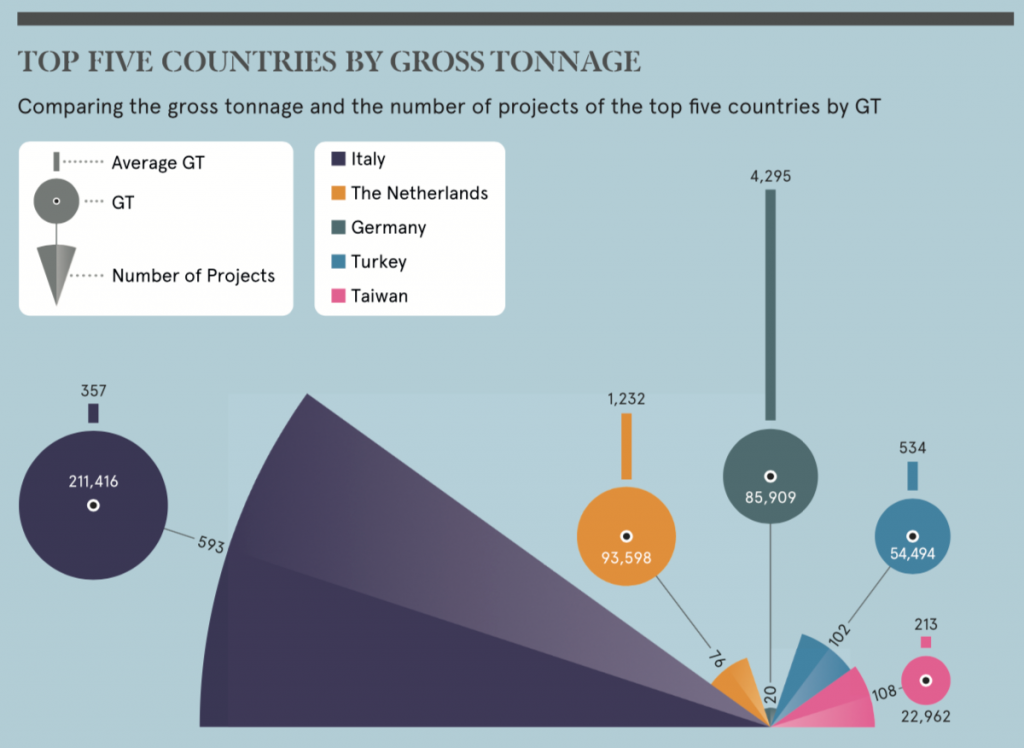

It is no surprise to record that Italy, once again, is building the most gross tonnage – 211,416GT, up 14 per cent. Germany has been dethroned by the Netherlands for second place. while Turkey is fourth and Taiwan takes fifth, with a total construction of 23.963 GT.

ACTIVE SHIPYARDS

While the number of active shipyards was still rising in the second half of 2021, this growth, too, has slowed. The total remains high, with 189 active yards, a net gain of three yards over 2022 (nine yards opened or resumed operation, but six closed). With fewer newcomers, the increase in orders is accounted for by expanded capacity at veteran builders such as Feadship, The Italian. Sea Group and Sanlorenzo, which have added more slots. Many older sheds have been brought. back into operation to soak up demand, which is rent in locations such as where there is a new shed “boom”, thanks to builders like Overmarine, Rossinavi and Siman.

A more detailed look at the order book shows 68 shipyards are building one project, down 15 per cent from last year. Seventy-two yards have three or more projects (+11 percent); 44 are building five ‘or more superyachts (+16 per cent), and 24 have 10 or more projects underway, equal to last year.

TOP-TEIR BUILDERS

The apex builders have strengthened their positions in the last 12 months. It is no surprise to find the Azimut-Benetti Group in first place, both for overall length of production and number of hulls in build. With 5,991 metres of projects ordered or under construction, this Italian juggernaut has boosted its order book by 1,390 metres. For the second consecutive year, it has grown more than 30 per cent. Sanlorenzo, retaining second place among top builders, posts 4,577 metres of construction, up 421 metres (+10.1 per cent). Like its yachts, this company continues to grow; it recently announced a contract for its new flagship, a 73-metre scheduled for a 2026 delivery.

According to our research, the Ferretti Group – comprising Ferretti, Custom Line, CRN, Riva, Pershing, Wally and Itama – likely occupies third place in this list, however, as in previous years, the company has declined to share precise order book data. Our estimate of their production – gleaned from press conferences, financial statements and a tally of previous years’ launches – are included only in the general numbers and tables.

Ocean Alexander and Feadship remain in the same places as last year, respectively third and fourth. Both, though, have seen a rise in orders. It is impressive to see Feadship announcing 1,672 metres of orders and an estimated 20 projects. After several years, Princess and Sunseeker are once again sharing order book data, and we can confidently say they sit in fifth and sixth places, respectively. These two British yards have seen considerable success with their semi-custom series between 24 and 30 metres. Princess has received no less than 28 orders for its new Y8o, while Sunseeker has 12 units of the brand new 100 Yacht scheduled for delivery in the coming years. Their production together represents 3,031 metres of yachts.

In seventh place is Liirssen, with 1,233 metres of construction. Along with Oceanco, at 17th place on this list, they are the only yards with an average project length in excess of 100 metres.

The Italian Sea Group also shows impressive growth, with a total of 1,149 metres of yachts in construction, up 392 metres from last year, an improvement of 53.1 per cent. This record follows the company’s acquisition of Perini Navi and Picchiotti and their remaining projects.

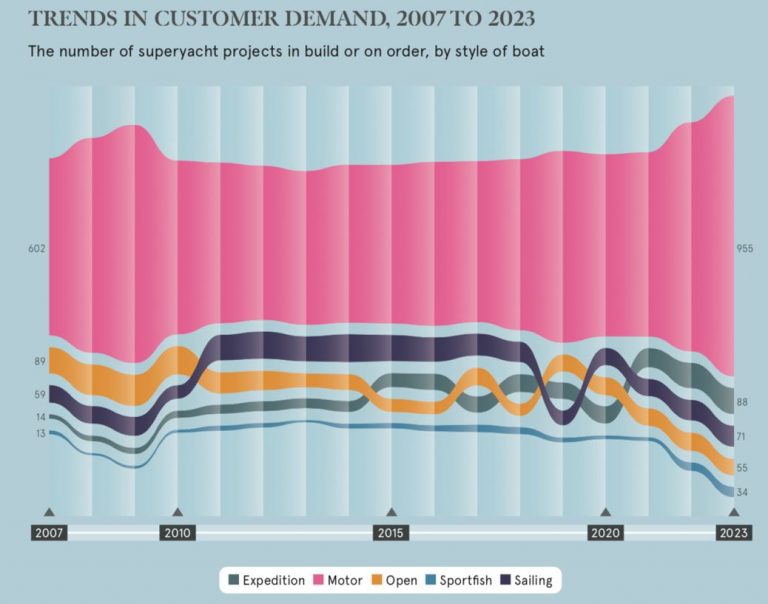

TYPES OF SUPERYACHT

The growth in the order book has happened solely on the power side – sailing yachts account for just 5.9 per cent of the Global Order Book, with 71 projects, one more than 2022. The large sailing yacht market has been flat for decades, but itis anticipated that high levels of activity in the sub-24-metre sailing sector and a growing appetite for multihull sailing will lead to more orders of larger sailing yachts in years to come. Semi-custom motor yachts, meanwhile, are now dominant. Some 955 of the 1,203 projects currently in build are semi-custom, a growth of 22 per cent. The expedition yacht market has grown again, but at a lower clip than previous years. We found 88 explorer projects in build, up three hulls on last year.

TOP BUILDER COUNTRIES

The top builder nations remain the same as last year but with more units for nearly all countries. Italy continues to lead the world with a new record – 22,056 metres of projects, accounting for 47-6 per cent of global superyacht production. The Netherlands is once again second, but notable is the average LOA of local projects, which is creeping up each year. The average length ofa Dutch yacht is now 65.6 metres, an increase of 3.02 metres compared to last year. Atleast nine projects exceeding 100 metres are currently under construction in the Netherlands, which is a new record. Third spot belongs to Turkey, whose strong order book totals 4,167 metres of construction.

In the second half of the Top 20, the UAE’s performance is notable, mainly thanks to the growing popularity and capacity of Gulf Craft. This yard manufactures most of the components for its yachts in-house and thus is less susceptible to supply-chain issues. A number of countries, meanwhile, have slipped, including Canada, France and Spain.

FULL CUSTOM VS SEMI CUSTOM

This is a fascinating and rapidly evolving part of the Global Order Book, as the number of full custom yachts under construction is continuing to shrink. In this latest count, we found 234 full custom projects underway, a decline of 20 units compared to the previous order book. As a proportion of the market, full custom projects account for 19.5 per cent of the total order book, down from 25 per cent in 2022.

Full custom projects tend to be the largest, but even at the very top of the market, their share of the order book is declining. The number of full custom projects over 50 metres LOA is down from 197 to 190. For the very largest yachts over 76 metres, meanwhile, full custom projects now account for 67 per cent of all orders, down from 74 per cent. Today’s buyers want shorter wait times, so builders are offering more

THE FINAL WORD

Our conclusions are similar to those we had last year – a mix of highs and lows, cautious optimism and mild concern. We are concerned about a dampening of enthusiasm fed by inflation and recession woes, about ongoing equipment delays from suppliers who can’t meet demand and, frankly, about a lack of inventory in some sectors.

More than three decades of compiling the Global Order Book has shown that it’s an international market much too driven by strong individuals to be contained by generalisations. However, we feel confident in noting that the diversity in new semi-custom series as well as the uniquely different missions driving the designs of large custom yachts indicates that many more lifestyles are represented in today’s superyachts than in decades past. This is a good thing that both reflects and attracts new people to the roster of superyacht owners. Even when it slows to catch its breath, the superyacht market is still one of the hottest games in town.

Source; https://www.boatinternational.com/boat-pro/global-order-book/global-order-book-2023-report